Nice Info About How To Get A Tax Pin

Select the button to get started.

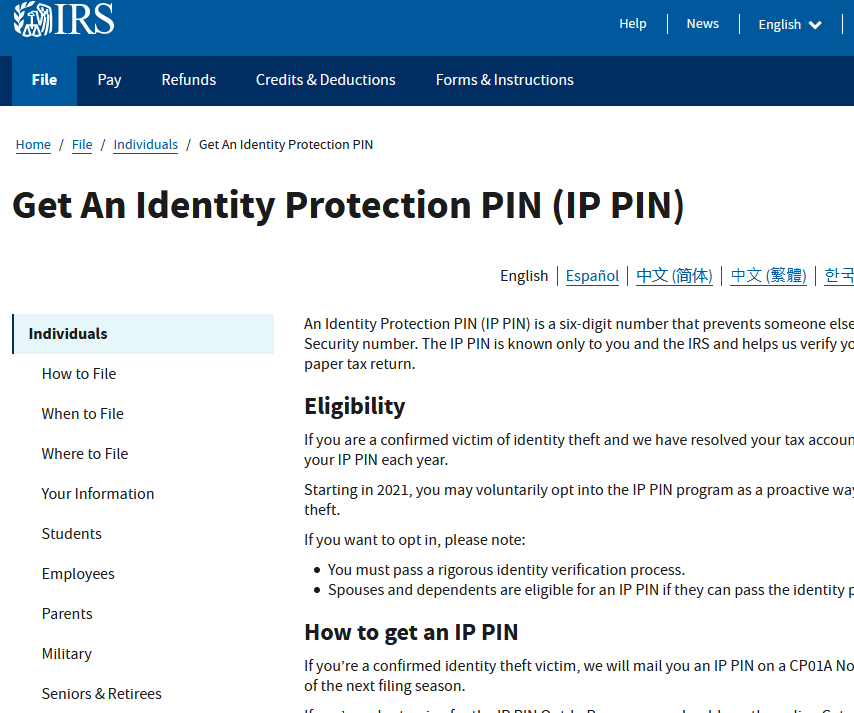

How to get a tax pin. A a a. Compared to a year ago, the budget deficit for 2023/24 is estimated to worsen from 4% to 4.9% of gross domestic product (gdp). Every taxpayer who receives an ip pin must enter it on.

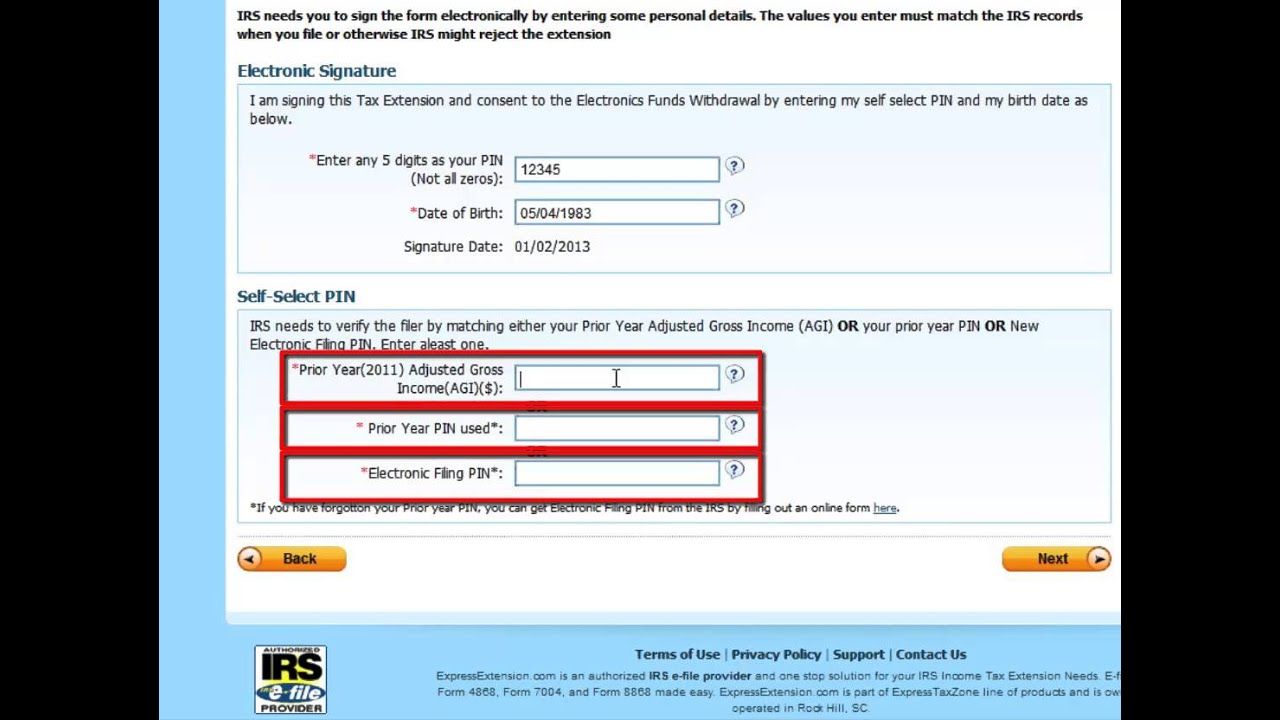

Retrieve your ip pin online at the irs's get an ip. With an online account, you can also request an identity protection pin to add an extra layer of security to your tax records. To get an ip pin that is lost, forgotten, or never arrived in a cp01a notice, use the ip pin request portal at irs.gov.

Tax experts advise creating an irs online account just in. The fastest way to receive an ip pin is by using the online get an ip pin tool. If you know you need an ip pin to file your taxes and you lost your cp01a letter (or never received it), you can:

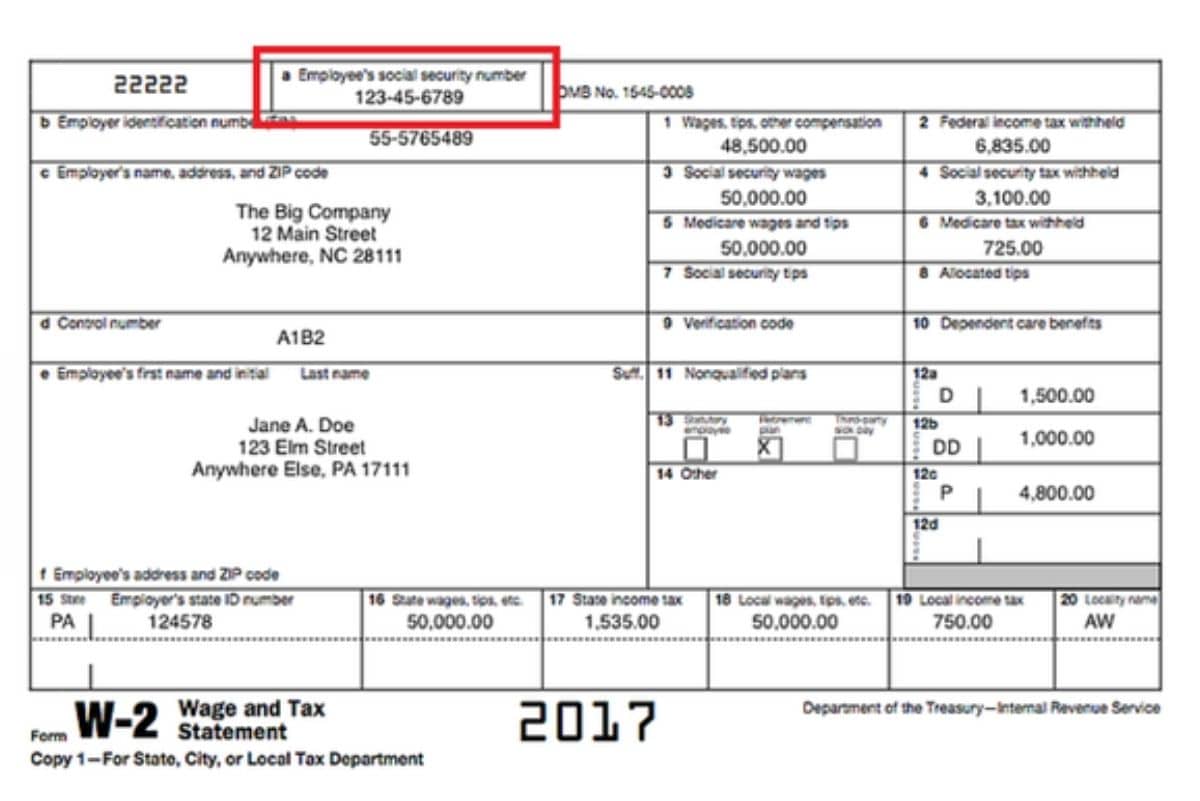

Access your t4 / t4a statements on workday. Anyone who has an ssn or itin and can verify their identity is eligible to enroll in the ip pin program. How to get your ip pin reissued.

Situs yang merupakan media informasi elektronik satu pintu meliputi penyimpanan dan pengelolaan informasi serta mekanisme penyampaian informasi dari penyelenggara. If the taxpayer uses a pin and owes taxes, can they pay. This is seen falling to 4.5% of gdp.

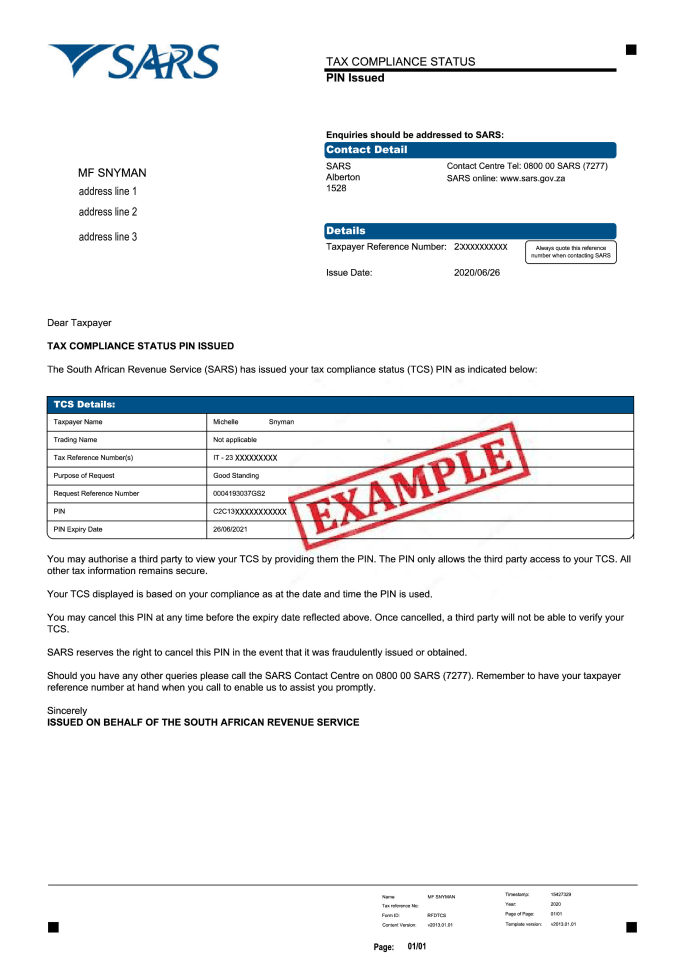

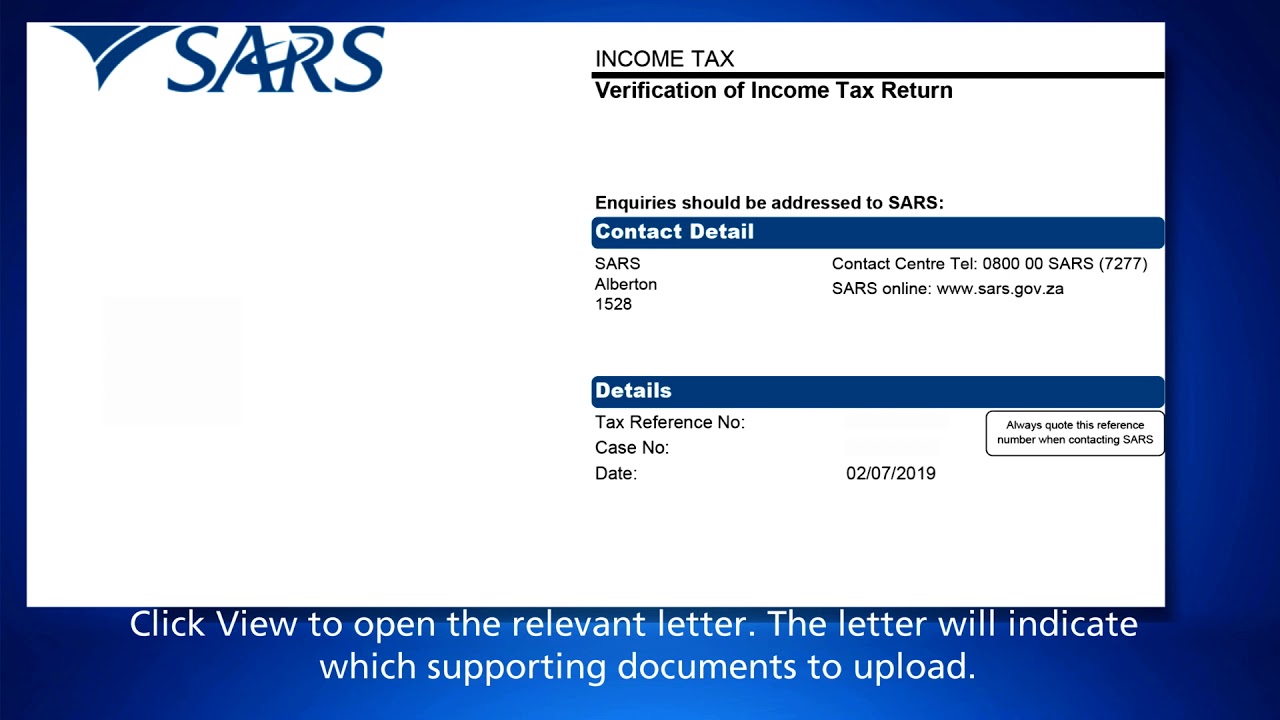

Access your sars efiling account. If you want to know how to get a sars tax clearance certificate/tax compliance status pin for your new business online then this video will give you an easy. Click tax status on the right side of the screen.

Anda juga bisa menghubungi melalui kontak atau mengunjungi website resmi kecamatan jika tersedia. If you wish to get an ip pin and you don’t already have an account on irs.gov, you must register to validate your identity. Cara mendapatkan qr code ktp digital adalah dengan mengajukan permohonan pencetakan melalui dinas kependudukan dan pencatatan sipil.